Prices are temporarily stable after the holiday, and production schedule is expected to increase significantly in March

2024-02-26 14:44Component prices are unchanged this week. For ground power stations, monocrystalline 182 double-sided costs 0.87 yuan/W, monocrystalline 210 double-sided costs 0.90 yuan/W, and TOPCon182 double-sided costs 0.92 yuan/W.

In terms of supply, module manufacturers have begun to resume work one after another after the holidays, but the overall production schedule is still low. In February, the module side production schedule was about 30-35GW. In the

second quarter, with the follow-up of overseas orders and the launch of domestic terminal projects, the production schedule has improved significantly. expected.

On the demand side, on February 9, India's MNRE announced that from April 1, 2024, photovoltaic projects funded by the Indian government will not be able to use Chinese photovoltaic modules. On February 15, MNRE announced

that the February 9 announcement was temporarily on hold. The postponement of ALMM will greatly promote India's module exports and increase module production schedule in March.

In terms of price, in the short term, spot prices have basically stabilized. The potential oversupply trend may further push down module prices, but long-term price reductions are unsustainable. Silicon material prices have continued to rebound for three weeks before the holiday, which has also provided support for the stabilization and recovery of module prices.

Silicon prices remained unchanged this week. The average reinvestment price of mono crystal is 61,900 yuan/ton, the average price of densified mono crystal is 59,400 yuan/ton, the average price of mono crystal cauliflower is 55,200

yuan/ton, the average price of N-type material is 71,900 yuan/ton, and the average price of N-type granular silicon is 6.10 Ten thousand yuan/ton.

In terms of supply, the overall production schedule before the holiday has basically remained stable, and new silicon material capacity will be launched in March after the holiday. In terms of price, it depends on the progress of new

production capacity and downstream demand.

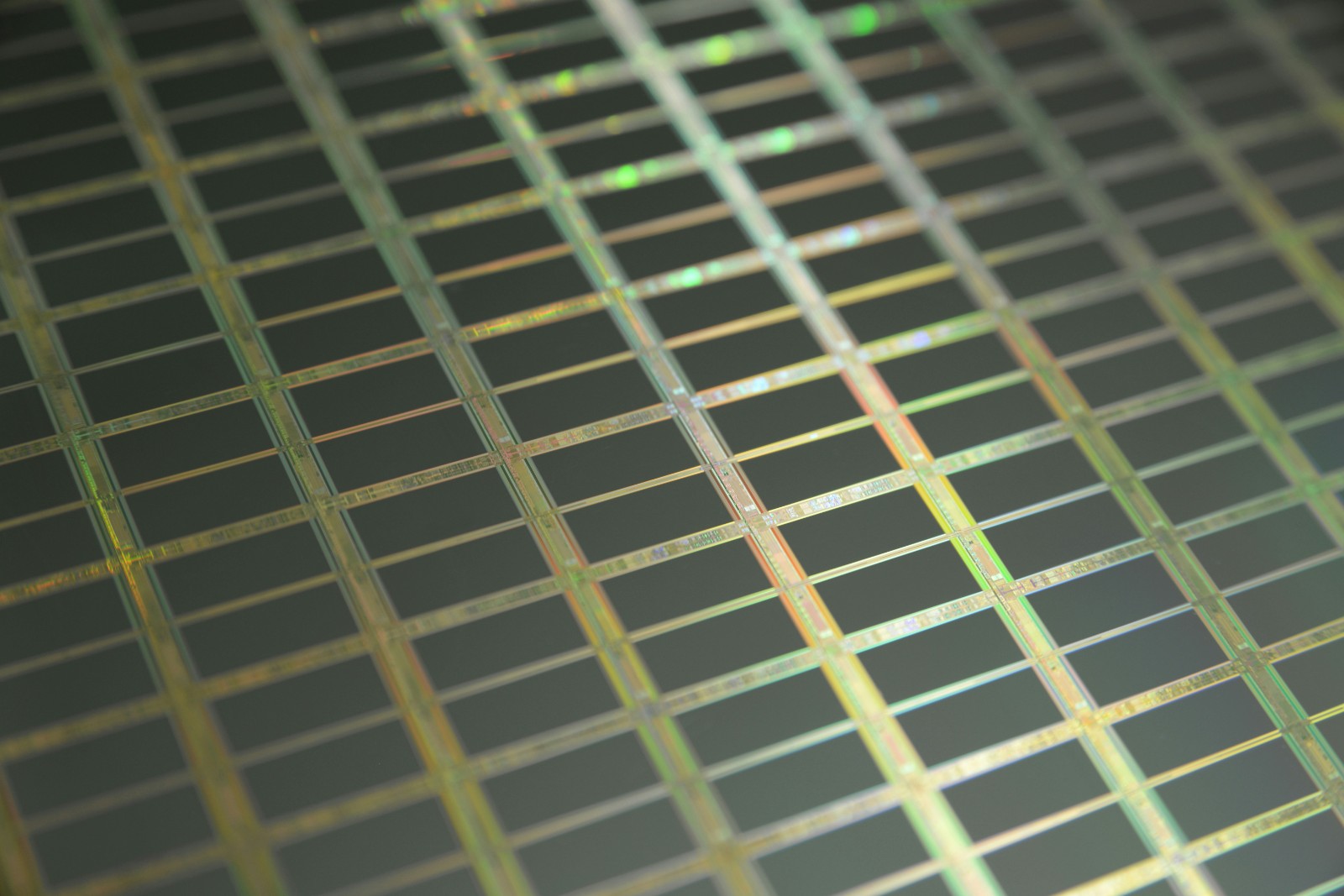

Silicon wafer prices were unchanged this week. The average price of monocrystalline 182 silicon wafers is 1.82 yuan/piece; the average price of monocrystalline 210 silicon wafers is 2.91 yuan/piece; the average price of N-type 210

silicon wafers is 3.10 yuan/piece.

In terms of supply and demand, although silicon prices have risen for several consecutive weeks, considering that the operating rate of silicon wafers has not been significantly reduced recently, silicon wafer production in February

was about 55GW, and the supply far exceeded downstream demand, resulting in a rapid increase in inventory, so silicon wafer prices It has remained stable over the past four weeks. Beginning in March, as downstream demand rebounds,

silicon wafer prices are expected to rise.

Battery cell prices remain unchanged this week. The average price of monocrystalline 182 cells is 0.38 yuan/W, the average price of monocrystalline 210 cells is 0.38 yuan/W, and the average price of N-type TOPCon monocrystalline 182 cells is 0.47 yuan/W.

On the supply side, battery-side production schedules are low in February, with output expected to be between 35-40GW. Therefore, prices are relatively supported, and battery production schedules are expected to increase significantly in March.